Corona Virus Aid, Relief and Economic Security ACT (H.R. 748)

Payroll Protection loans

In addition to the tax provisions we previously reported, the CARES Act provides for Payroll Protection loans of up to $10 million to COVID-19 impacted businesses:

- The loans are guaranteed 100% by the Small Business Administration (no personal guarantees or collateral required);

- Businesses with 500 or fewer employees can borrow 2.5 times their average monthly payroll, up to a maximum of $10 million;

- The loans may be forgiven for amounts used to cover basic operating expenses such as payroll costs, rent and mortgage, and utilities for up to eight weeks from the loan origination date;

- Loan forgiveness will be reduced by reductions in employee compensation or layoffs of employees over the last year;

- The canceled debt will not generate taxable income;

- Businesses that take these loans will not qualify for the Employer Retention Credit;

- Any loan amount that isn’t forgiven has a maximum term of 10 years and a maximum interest rate of 4%; and

- At press time, the SBA had not provided information to banks on the loan process, but we expect that to happen soon.

Read full CARES Act (H.R. 748) https://www.congress.gov/bill/116th-congress/house-bill/748/text

PLANNING OPPORTUNITY: Section 1106 of CARES Act allows for loan forgiveness in an amount equal to approximately 8-weeks of payroll, rent, utilities and certain interest. Contact your SBA advisor for more information.

Employer Retention Credit

The CARES Act also contains a refundable employer retention credit against quarterly employment taxes for employers impacted by COVID-19:

- Impacted employers are those who fully or partially suspended operations due to COVID-19 or whose gross receipts declined in a quarter by more than 50% compared to the prior year;

- The credit is equal to 50% of qualified wages paid after March 12, 2020, and before January 1, 2021, up to a $5,000 maximum per credit;

- The credit is claimed against the 6.2% employer’s portion of Social Security taxes;

- The IRS will be providing refund advances; and

- The credit cannot be claimed by businesses receiving a CARES Act Payroll Protection loan from the Small Business Administration.

Rather than wait weeks after the employer has filed its quarterly Form 941, the IRS has set up two alternative ways employers can cash in these credits quickly:

- They can retain the following employment taxes rather than depositing them:

- Federal income taxes withheld for all employees;

- The employee’s share of Social Security and Medicare taxes (but only for the employee who received the paid benefits or qualified wages); and

- The employer’s share of Social Security and Medicare taxes for all employees; or

- Alternatively, employers may file Form 7200, Advance Payment of Employer Credits Due to COVID-19, to expedite a refund of the credit due in excess of the amount of previously retained employment taxes. The IRS has stated that they will try to issue refunds within two weeks.

Form 7200 may be filed for an advance payment of the credits anticipated for a quarter at any time before the end of the month following the quarter in which the employer paid the qualified wages. If necessary, it can be filed several times during each quarter.

Submit Form 7200 by faxing it to (855) 248-0552.

Form 7200 is available at:

www.irs.gov/forms-pubs/about-form-7200

Stimulus payments (Employees)

- The payment is an advance payment of a 2020 tax credit;

- The maximum credit is $1,200 per individual ($2,400 MFJ) plus $500 per qualifying child under 17 years old;

- The credit is phased out by 5% ($5 for every $100 over the limit) for AGIs exceeding:

- $150,000 for MFJ — phased out at $198,000 if there are no children;

- $112,500 for HOH filers — phased out at $146,500 if the HOH has one child;

- $75,000 for all other taxpayers — phased out at $99,000; and

- For every child claimed, add an additional $10,000.

- For people who have already filed their 2019 tax returns, the IRS will use this information to calculate the payment amount. For those who have not yet filed their return for 2019, the IRS will use information from their 2018 tax filing to calculate the payment. The stimulus payment will be deposited directly into the same banking account reflected on the return filed;

- For taxpayers who did not provide direct deposit information, in the coming weeks the Treasury plans to develop a web-based portal for individuals to provide their banking information to the IRS online so that individuals can receive payments immediately as opposed to checks in the mail; and

- For individuals who did not file a 2018 or 2019 return, the IRS is developing a simplified process for them to file.

Here is a link to the IRS’s FAQs on these payments:

www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know

Arrache CPA

Arrache CPA

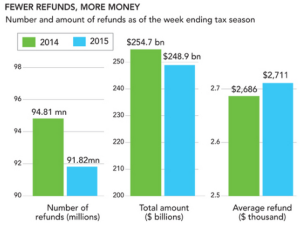

Refund Season? As data shows, the 2014 tax year had less refunds but bigger refunds.

Refund Season? As data shows, the 2014 tax year had less refunds but bigger refunds.