Naming the New Year: 2024 “Bucking Bull”

Like many people, I enjoy a good tradition.

Whether it is a familiar tradition like the family vacation or nightly family dinners, One of our favorite Traditions is Naming the New Year.

The New Year Name is chosen before the new year starts and will reflect important plans, challenges, obstacles, etc. ahead in the New Year.

Typically We’ve used a simple nomenclature = action + name

For instance,

- 2019 – “Riding Tiger”

- 2020 – “Running Bear”

- 2021 – “Soaring Eagle”

- 2022 – “Hanging Man”

- 2023 – “Hungry Hummingbird”

- 2024 – “Bucking Bull”

Why is this important?

In my experience, the tradition of naming the New Year has been at times inspirational, accurate and foreboding.

2023 “Hungry Hummingbird”, for example, was pretty accurate for the volatile Housing Markets and true to form, unexpected but awesome, rebound of the Stock Markets.

As entrepreneurs and business owners, it is important to work IN your business as well as work ON your business. The New Year name helps us associate an idea larger than any 1 person and at the same time focus 100% on the work at hand.

2024 “Bucking Bull” will be a year of energy, enthusiasm and competition. Much like riding a Bucking Bull, Smart Business will navigate uncertain economy and avoid getting dragged into uncontrolled situations. It will be more important then ever to stay enthusiastic and align your journey with competitive advantages.

A lot of people probably stopped reading when I said “nightly family dinners”, but for those of you who appreciate a tradition, We wish you a happy and safe New Year and best wishes in 2024.

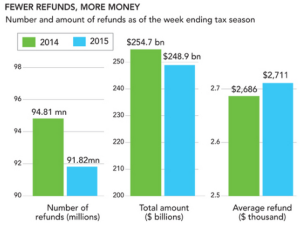

Refund Season? As data shows, the 2014 tax year had less refunds but bigger refunds.

Refund Season? As data shows, the 2014 tax year had less refunds but bigger refunds.