TAX DUE DATE – Business & Trust/Estate Taxes – September 15th, 2015 – Are you ready?

September 15, 2015 – This is the last day to file a 2014 calendar year income tax return for your:

- Corporation

- Partnership

- Trust/Estate

Be aware – This due date applies only if you timely requested a 6-month or 5-month extension. If you did not file an extension then there is even more urgency to file your tax return as soon as possible – expect penalties and interest if this is the case, but contact us immediately and let’s get those penalties abated!

Also, you must deposit the third installment of estimated income tax for 2015.

If you need help filing or have questions, feel free to call us today for a FREE initial consultation (800) 425-0570 or email questions to Contact@MrSmartTax.com

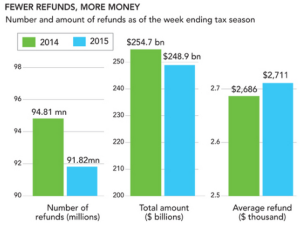

Refund Season? As data shows, the 2014 tax year had less refunds but bigger refunds.

Refund Season? As data shows, the 2014 tax year had less refunds but bigger refunds.

The average US household carries approximately $16,000 of credit card debt; average mortgage debt $157,000; average student loan $33,000 (source http://tiny.cc/ee3q0x) … that is approximately $10,000 of interest per year :/

The average US household carries approximately $16,000 of credit card debt; average mortgage debt $157,000; average student loan $33,000 (source http://tiny.cc/ee3q0x) … that is approximately $10,000 of interest per year :/