Posts

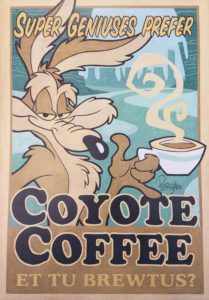

New Office Artwork!

/0 Comments/in News /by mrarracheThank you Craig Kausen, Linda Jones Enterprises and the Chuck Jones Center For Creativity for the new office artwork! #whatsupdoc #wileecoyote

Too many tax clients? Want to sell your tax practice?

/0 Comments/in News /by mrarrache

Too many tax clients? Want to sell your tax practice? If yes, then I would like to extend to you an invitation to our practitioner network for tax client referrals & tax practice acquisitions – we offer a “dollar per client” or “% of fee”. We have had tremendous success growing organically, but we always enjoy and look forward to working with local tax preparers if for nothing else than to get tax practice tips. To discuss more, you can reach me at (949) 877-3143 or by email at MRarrache@MrSmartTax.com

Thank you.

Sincerely,

Owner – Mr. Smart Tax, Inc.

Tax Season is Coming – Are You Ready?

/0 Comments/in News /by mrarracheWith the end of the 2016 year quickly approaching, it means that tax season is right around the corner. Are you ready?

Mr. Smart Tax, Inc. is one of the leading full service CPA firms with offices located throughout California. We offer a full range of tax, accounting and financial advisory services and give trusted advice to our clients.

Call Mr. Smart Tax today to schedule your free initial consultation. (949)877-3143

December 15th 6:30pm-9:00pm Intro to QuickBooks

/0 Comments/in Events /by mrarracheMr. Smart Tax, Inc. is excited to present an introductory course on the basics of accounting and Quickbooks software geared for small businesses and self-employed individuals. Learn how to quickly and efficiently gain control over your finances with this powerful accounting software program.

MUST bring your own laptop. You will be provided with all other course materials and free trial of QuickBooks.

Call to register today:

Register for FREE Event HERE

Time: 6:30pm-9:00pm Thursday December 15, 2016

Location: Mr. Smart Tax, Inc.

4590 MacArthur Blvd., 5th Floor

Newport Beach, CA 92660

Directions: We are located in Wells Fargo building at the corner of MacArthur and Birch. Parking lot entrance off of Birch. Take the elevator in the main lobby to the 5th floor and go right to reception desk on 5th floor.

Tax Day Freebies

/0 Comments/in News /by mrarracheWhile tax day might be a terrible day for some, there are some freebies out there that you can take advantage of. Read more here…

Iggy Azalea Tax Troubles & Tips For Paying Off The IRS

/0 Comments/in News /by mrarrache Pop singer Iggy Azalea has skirted confirming rumors of IRS troubles to the tune of $400,000. Iggy recently tweeted @IGGYAZALEA “The IRS gave the option to pay them monthly or lump sum. i picked monthly, who wouldnt?”

Pop singer Iggy Azalea has skirted confirming rumors of IRS troubles to the tune of $400,000. Iggy recently tweeted @IGGYAZALEA “The IRS gave the option to pay them monthly or lump sum. i picked monthly, who wouldnt?”

Great question Iggy. Read below for facts regarding late payments, installment agreements and tips for taxpayers who owe the IRS money.

Failure-to-pay Penalty – If you do not pay your taxes by the tax deadline, you normally will face a failure-to-pay penalty of ½ of 1 percent of your unpaid taxes. That penalty applies for each month or part of a month after the due date and starts accruing the day after the tax-filing due date. If Iggy owes the Feds $400,000, that means she is accruing $2,000/month of failure-to-pay penalty until her installment agreement is accepted, then reduced there-after.

Installment Agreements – An installment agreement is an option for those who cannot pay their entire tax bills by the due date. Penalties are reduced, although interest continues to accrue on the outstanding balance. In order to qualify for the new expanded streamlined installment agreement, a taxpayer must agree to monthly direct debit payments. Taxpayers seeking installment agreements exceeding $50,000 will still need to supply the IRS with a Collection Information Statement (Form 433-A or Form 433-F). Taxpayers may also pay down their balance due to $50,000 or less to take advantage of this payment option. The maximum term for streamlined installment agreements has also been raised to 72 months from the current 60-month maximum.Ten Tips for

General Tips for Taxpayers Who Owe Money to the IRS –

- Tax bill payments If you get a bill this summer for late taxes, you are expected to promptly pay the tax owed including any penalties and interest. If you are unable to pay the amount due, it is often in your best interest to get a loan to pay the bill in full rather than to make installment payments to the IRS.

- Additional time to pay based on your circumstances, you may be granted a short additional time to pay your tax in full. A brief additional amount of time to pay can be requested through the Online Payment Agreement application at www.irs.gov or by calling 800-829-1040.

- Credit card payments You can pay your bill with a credit card. The interest rate on a credit card may be lower than the combination of interest and penalties imposed by the Internal Revenue Code. To pay by credit card contact one of the following processing companies: Link2Gov at 888-PAY-1040 (or www.pay1040.com), RBS WorldPay, Inc. at 888-9PAY-TAX (or www.payUSAtax.com), or Official Payments Corporation at 888-UPAY-TAX (or www.officialpayments.com/fed).

- Electronic Funds Transfer You can pay the balance by electronic funds transfer, check, money order, cashier’s check or cash. To pay using electronic funds transfer, use the Electronic Federal Tax Payment System by either calling 800-555-4477 or using the online access at www.eftps.gov.

- Installment Agreement You may request an installment agreement if you cannot pay the liability in full. This is an agreement between you and the IRS to pay the amount due in monthly installment payments. You must first file all required returns and be current with estimated tax payments.

- Online Payment AgreementIf you owe $25,000 or less in combined tax, penalties and interest, you can request an installment agreement using the Online Payment Agreement application at www.irs.gov.

- Form 9465You can complete and mail an IRS Form 9465, Installment Agreement Request, along with your bill in the envelope you received from the IRS. The IRS will inform you (usually within 30 days) whether your request is approved, denied, or if additional information is needed.

- Collection Information Statement You may still qualify for an installment agreement if you owe more than $25,000, but you are required to complete a Form 433F, Collection Information Statement, before the IRS will consider an installment agreement.

- User fees If an installment agreement is approved, a one-time user fee will be charged. The user fee for a new agreement is $105 or $52 for agreements where payments are deducted directly from your bank account. For eligible individuals with lower incomes, the fee can be reduced to $43.

- Check withholding Taxpayers who have a balance due may want to consider changing their W-4, Employee’s Withholding Allowance Certificate, with their employer. A withholding calculator at www.irs.gov can help taxpayers determine the amount that should be withheld.

More info about Iggy’s Tax Troubles

Call Mr. Smart Tax, Inc. if you need help with IRS tax debt relief. (800) 425-0570

CONTACT US

4590 MacArthur Blvd

5th Floor

Newport Beach, CA 92660

(800) 425-0570 Info@mrarrachecpa.com

About

Mr. Smart Tax, Inc. Provides Tax, Accounting and Resolution for Business, Individual, Trust and Nonprofit clients.