Posts

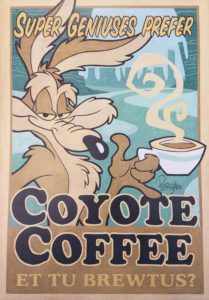

New Office Artwork!

/0 Comments/in Articles & Publications /by mrarracheThank you Craig Kausen, Linda Jones Enterprises and the Chuck Jones Center For Creativity for the new office artwork! #whatsupdoc #wileecoyote

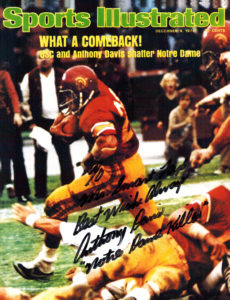

Tax Season Kickoff With New Office Memorabilia!

/0 Comments/in Articles & Publications /by mrarracheCalifornia Appellate Court Rules Against FTB in Swart Case

/0 Comments/in Articles & Publications /by mrarracheSwart case could be a small but notable victory for out-of-state ownership of a California LLC.

Currently, California’s franchise tax is imposed on the net income of every corporation “doing business within the limits of this state.” (§ 23151, subd. (a).) For tax years prior to January 1, 2011, section 23101 defined “doing business” as “actively engaging in any transaction for the purpose of financial or pecuniary gain or profit.” 2 (Former § 23101, now § 23101, subd. (a).) The term “actively” is the opposite of “passively” or “inactively” and means “active transaction for pecuniary gain or profit.” (Golden State Theatre & Realty Corp. v. Johnson (1943) 21 Cal.2d 493, 496 (Golden State Theatre); Hise v. McColgan (1944) 24 Cal.2d 147, 151.)

In this case, the $800 minimum franchise tax was imposed upon Swart several years after Swart made its investment and became a member of Cypress LLC. Swart argued that it was not doing business in California and that it passively held onto its investment in the tax year the franchise tax was imposed.

The Franchise Tax Board (FTB) demanded that Swart file a California corporate franchise tax return for the tax year ending June 30, 2010, and pay the $800 minimum franchise tax due on that return. Swart paid the tax, which amounted to $1,106 with penalties and interest, but contested it and requested a refund.

Swart claimed it was not subject to the franchise tax because it held no other investments in California, it did not otherwise do business in California, and it was only a passive member in Cypress LLC. Swart further claimed imposition of the franchise tax violated the due process clause and commerce clause of the United States Constitution. The FTB denied Swart’s request for refund.

Swart timely filed a complaint seeking a tax refund and declaratory relief. After briefing and argument on the parties’ cross-motions for summary judgment, the trial court entered an order granting Swart’s motion for summary judgment and denying the FTB’s motion for summary judgment. Swart was awarded a refund in the amount of $1,106.71.

Read court document here http://www.courts.ca.gov/opinions/documents/F070922.PDF

Too many tax clients? Want to sell your tax practice?

/0 Comments/in Articles & Publications /by mrarrache

Too many tax clients? Want to sell your tax practice? If yes, then I would like to extend to you an invitation to our practitioner network for tax client referrals & tax practice acquisitions – we offer a “dollar per client” or “% of fee”. We have had tremendous success growing organically, but we always enjoy and look forward to working with local tax preparers if for nothing else than to get tax practice tips. To discuss more, you can reach me at (949) 877-3143 or by email at MRarrache@MrSmartTax.com

Thank you.

Sincerely,

Owner – Mr. Smart Tax, Inc.

As Holidays Approach, IRS Reminds Taxpayers of Refund Delays in 2017

/0 Comments/in Articles & Publications /by mrarrache

IR-2016-152, Nov. 22, 2016

WASHINGTON — As the holidays approach, the Internal Revenue Service today reminded taxpayers to remember that a new law requires the IRS to hold refunds until mid-February in 2017 for people claiming the Earned Income Tax Credit or the Additional Child Tax Credit. In addition, new identity theft and refund fraud safeguards put in place by the IRS and the states may mean some tax returns and refunds face additional review.

Economic Troubles Ahead? Clean Up, Save Up, Understand & Review

/0 Comments/in Articles & Publications /by mrarracheWhether you prefer hands on investing or hiring wealth managers, start saving money and protect your portfolio. Healthy cash reserves cover 12-24 months of living expenses, but 6 month reserves is a great start. Most importantly keep an eye on your investments and make smart moves with your money.

John Riley, AIF from Cornerstone Investment Services is worried about the economy. In his recent article published June 2016, he discusses 4 charts that indicate negative economic trends and 4 helpful tips to protect your portfolio .

Ultimately the key to fortifying your financial position is to clean up, save up, understand & review – Mr. Smart Tax, Inc. is here to help. Schedule your free initial consultation today!

(800)-425-0570 or email us at contact@MrSmartTax.com

Read full article by John Riley here…

Tax Day Freebies

/0 Comments/in Articles & Publications /by mrarracheWhile tax day might be a terrible day for some, there are some freebies out there that you can take advantage of. Read more here…

CONTACT US

4590 MacArthur Blvd

5th Floor

Newport Beach, CA 92660

(800) 425-0570 Info@mrarrachecpa.com

About

Mr. Smart Tax, Inc. Provides Tax, Accounting and Resolution for Business, Individual, Trust and Nonprofit clients.