Posts

Thoughts on government #Tax

/0 Comments/in News /by mrarracheMark Twain quotes on government click here

September 17th 6pm-8:30pm Personal Finance and Money Management

/0 Comments/in Events /by mrarrache Mr. Smart Tax, Inc. will be presenting an exciting course on the basics of personal finance and managing your money. Learn how to take control of your money and strengthen your financial health whether you are starting out on your own, starting to invest or getting ready for retirement. Call to register today (800) 425-0570 or register online here

Mr. Smart Tax, Inc. will be presenting an exciting course on the basics of personal finance and managing your money. Learn how to take control of your money and strengthen your financial health whether you are starting out on your own, starting to invest or getting ready for retirement. Call to register today (800) 425-0570 or register online here

Date/Time: September 17th 6pm-8:30pm (networking & refreshments 6pm-6:30pm; presentation 6:30pm-8:30pm)

Location: Mr. Smart Tax, Inc.

4590 MacArthur Blvd., 5th Floor

Newport Beach, CA 92660

Equal vs Fair – What is the difference?

/0 Comments/in News /by mrarracheToday there are many reference to fair and equal, but do we really understand what these words mean? Do the politicians blasting their fair an equal message understand what they’re talking about?

In the most basic sense:

Fair = in accordance with the rules or standards; legitimate.

Equal = a person or thing considered to be the same as another in status or quality.

What do you think? Is being fair more important than being equal or is equality more important than fairness? Can both exist simultaneously?

#Marijuana: High On #Taxes

/0 Comments/in News /by mrarracheLegally selling marijauna? Federal law prohibits deductions for business expenses such as rent, office expenses, etc. however the IRS concedes that excise taxes levied by states on the sale of marijuana can be written off due to the fact that the tax is a reduction on the amount realized in the sale. Currently the state of Washington charges and Colorado charge a 37% and 15% tax respectively on the retail sale of marijuana. What is also notable is that the IRS will allow a deduction for the cost of the marijuana that is sold but not forfeited – a taxpayer in California had his medical dispensary raided by the feds and was not allowed to deduct the cost of the marijuana that was seized due to the fact that there was no sale.

Read more on Marijuana taxes….

Marvel Comics $16M Super Mutant Tax Trouble

/0 Comments/in News /by mrarracheNot even superheroes can save Marvel Entertainment LLC from the IRS who assessed the comic company $16.6 million in tax deficiencies due the company harvesting losses from bankrupt companies. Marvel Entertainment Group Inc and some of its subsidiaries filed for bankruptcy in 1996 and there remained approximately $97 million of net operating losses (“nol’s”) which were then carried forward to the successor company the Marvel Group in 1998. As a result the Marvel group was able to reduce taxable income with these nol’s for the years 1999-2004. According to the IRS their method of doing so was a no-no. Something tells me that his superhero magnate is not down for the count just yet…

http://tiny.cc/wjh50x

My Fair Flat Tax – Is It Really Fair?

/0 Comments/in News /by mrarracheWould a 14.5% flat tax really be fair? Many Americans are not even sure how much they pay in taxes. With median income at $53,891[1] most American’s would end up paying $7,815 in taxes with a 14.5% flat tax rate which would be more than their income tax of $7,176 under the current tax code.

Also, Rand Paul’s flat tax would eliminate FICA with a combined tax rate of 7.65% on wages, however, this would have seriously detrimental effects on social security and medicare which are becoming deeply ingrained in the United States as more and more Americans reach retirement age or rely on the medical subsidies of medicare.

Food for thought – the 15% tax bracket stops at $36,900 for single taxpayers and $73,800 for married taxpayers. Who would this flat tax really benefit?

[1] source Sentier Research/CNN.com

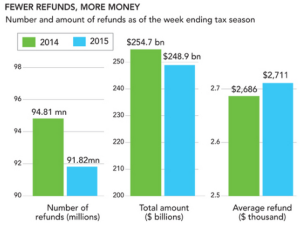

The Ups and Downs of Refund Season 2014

/0 Comments/in News /by mrarrache Refund Season? As data shows, the 2014 tax year had less refunds but bigger refunds.

Refund Season? As data shows, the 2014 tax year had less refunds but bigger refunds.

With the aid of government subsidized credits – the premium tax credit for health insurance, earned income credit for low income taxpayers and education credits – refunds increased for low income taxpayers while taxpayers with incomes typically over $50K saw their taxes go up and their refunds go away.

Some will argue that the taxpayer with income over $50K subsidizes the under $50K income taxpayer, but none the less these trends do not seem to be reversing anytime soon and with the 2016 election race underway it will be interesting to see how this plays out.

Chicago: Cloud Tax?

/0 Comments/in News /by mrarrache The city of Chicago announced recently that is plans to add a 9% tax on “electronically delivered amusements” such as Netflix and Spotify. Currently several major cities around the U.S. tax the sale of physical goods over the internet, but Chicago will be the first city to tax the streaming of entertainment media.

The city of Chicago announced recently that is plans to add a 9% tax on “electronically delivered amusements” such as Netflix and Spotify. Currently several major cities around the U.S. tax the sale of physical goods over the internet, but Chicago will be the first city to tax the streaming of entertainment media.

While this sounds great for Chicago bureaucrats, the 1996 Telecommunications Act and the 1998 Internet Tax Freedom Act may roadblock this “cloud tax”.

http://tiny.cc/i2lu0x

Greece vs. America – The Average American Could Be Worse Off

/0 Comments/in News /by mrarracheGreece is in serious trouble – but what about the average American?  The average US household carries approximately $16,000 of credit card debt; average mortgage debt $157,000; average student loan $33,000 (source http://tiny.cc/ee3q0x) … that is approximately $10,000 of interest per year :/

The average US household carries approximately $16,000 of credit card debt; average mortgage debt $157,000; average student loan $33,000 (source http://tiny.cc/ee3q0x) … that is approximately $10,000 of interest per year :/

However, unlike Greece, if an American claims bankruptcy there is no reprieve from certain types of debt i.e. student loans or taxes which essentially creates a “debt prison”.

http://tiny.cc/u32q0x

CONTACT US

4590 MacArthur Blvd

5th Floor

Newport Beach, CA 92660

(800) 425-0570 Info@mrarrachecpa.com

About

Mr. Smart Tax, Inc. Provides Tax, Accounting and Resolution for Business, Individual, Trust and Nonprofit clients.