Posts

Business and Individual Income Tax and Accounting Services

/0 Comments/in Articles & Publications /by mrarracheCalifornia Appellate Court Rules Against FTB in Swart Case

/0 Comments/in Articles & Publications /by mrarracheSwart case could be a small but notable victory for out-of-state ownership of a California LLC.

Currently, California’s franchise tax is imposed on the net income of every corporation “doing business within the limits of this state.” (§ 23151, subd. (a).) For tax years prior to January 1, 2011, section 23101 defined “doing business” as “actively engaging in any transaction for the purpose of financial or pecuniary gain or profit.” 2 (Former § 23101, now § 23101, subd. (a).) The term “actively” is the opposite of “passively” or “inactively” and means “active transaction for pecuniary gain or profit.” (Golden State Theatre & Realty Corp. v. Johnson (1943) 21 Cal.2d 493, 496 (Golden State Theatre); Hise v. McColgan (1944) 24 Cal.2d 147, 151.)

In this case, the $800 minimum franchise tax was imposed upon Swart several years after Swart made its investment and became a member of Cypress LLC. Swart argued that it was not doing business in California and that it passively held onto its investment in the tax year the franchise tax was imposed.

The Franchise Tax Board (FTB) demanded that Swart file a California corporate franchise tax return for the tax year ending June 30, 2010, and pay the $800 minimum franchise tax due on that return. Swart paid the tax, which amounted to $1,106 with penalties and interest, but contested it and requested a refund.

Swart claimed it was not subject to the franchise tax because it held no other investments in California, it did not otherwise do business in California, and it was only a passive member in Cypress LLC. Swart further claimed imposition of the franchise tax violated the due process clause and commerce clause of the United States Constitution. The FTB denied Swart’s request for refund.

Swart timely filed a complaint seeking a tax refund and declaratory relief. After briefing and argument on the parties’ cross-motions for summary judgment, the trial court entered an order granting Swart’s motion for summary judgment and denying the FTB’s motion for summary judgment. Swart was awarded a refund in the amount of $1,106.71.

Read court document here http://www.courts.ca.gov/opinions/documents/F070922.PDF

Tax Day Freebies

/0 Comments/in Articles & Publications /by mrarracheWhile tax day might be a terrible day for some, there are some freebies out there that you can take advantage of. Read more here…

Real Estate Inherited From a Deceased Spouse? Step Up Your Tax Knowledge

/0 Comments/in Articles & Publications /by mrarrache Did you inherit real estate from a deceased spouse? The internal revenue code has special tax treatment for valuing the basis of inherited property regardless if you have estate tax filing requirements and no doubt this will impact you.

Did you inherit real estate from a deceased spouse? The internal revenue code has special tax treatment for valuing the basis of inherited property regardless if you have estate tax filing requirements and no doubt this will impact you.

If the inherited property has appreciated in value, the surviving spouse will generally receive a step up in basis of the inherited property to the fair market value (FMV) at:

1) the date of decedent’s death or

2) on the alternate valuation date (within 6 month of the date of death).

Further, in community property states (i.e. California, Arizona, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin), married individuals are typically considered to each own 50% of the community property. As such, when either spouse dies, the entire value of the community property, including the part owned by the surviving spouse, receives a step up in basis to the FMV. For this rule to apply at least 50% of the value of the community property must be included in the deceased spouse’s gross estate regardless if the deceased spouse’s estate must file a estate tax return.

Further, in community property states (i.e. California, Arizona, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin), married individuals are typically considered to each own 50% of the community property. As such, when either spouse dies, the entire value of the community property, including the part owned by the surviving spouse, receives a step up in basis to the FMV. For this rule to apply at least 50% of the value of the community property must be included in the deceased spouse’s gross estate regardless if the deceased spouse’s estate must file a estate tax return.

These rules can come in handy when a surviving spouse is in need of liquid capital. It should be noted that this special tax treatment can have adverse consequences if not handled correctly. Consult your tax adviser for more information.

Sources:

Jerry Brown Abandons Middle Class Californians, Vetoes AB 99 COD Conformity Bill

/0 Comments/in Articles & Publications /by mrarracheOctober 1st 3pm-5pm Professional Networking Mixer #ThirstyThursday

/0 Comments/in Events /by mrarracheTAX DUE DATE – Business & Trust/Estate Taxes – September 15th, 2015 – Are you ready?

/0 Comments/in Articles & Publications /by mrarracheSeptember 15, 2015 – This is the last day to file a 2014 calendar year income tax return for your:

- Corporation

- Partnership

- Trust/Estate

Be aware – This due date applies only if you timely requested a 6-month or 5-month extension. If you did not file an extension then there is even more urgency to file your tax return as soon as possible – expect penalties and interest if this is the case, but contact us immediately and let’s get those penalties abated!

Also, you must deposit the third installment of estimated income tax for 2015.

If you need help filing or have questions, feel free to call us today for a FREE initial consultation (800) 425-0570 or email questions to Contact@MrSmartTax.com

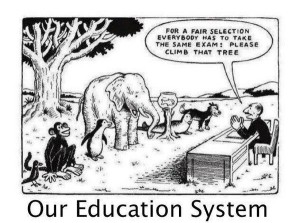

Equal vs Fair – What is the difference?

/0 Comments/in Articles & Publications /by mrarracheToday there are many reference to fair and equal, but do we really understand what these words mean? Do the politicians blasting their fair an equal message understand what they’re talking about?

In the most basic sense:

Fair = in accordance with the rules or standards; legitimate.

Equal = a person or thing considered to be the same as another in status or quality.

What do you think? Is being fair more important than being equal or is equality more important than fairness? Can both exist simultaneously?

PG&E Deduct Pollution Penalties For Tax Purposes?

/0 Comments/in Articles & Publications, Uncategorized /by mrarracheCONTACT US

4590 MacArthur Blvd

5th Floor

Newport Beach, CA 92660

(800) 425-0570 Info@mrarrachecpa.com

About

Mr. Smart Tax, Inc. Provides Tax, Accounting and Resolution for Business, Individual, Trust and Nonprofit clients.