Posts

LLC vs S Corporation – What’s the difference?

/0 Comments/in News /by mrarrache

Most every business start-up has come across the question “LLC or S corporation?”.

While this is a very common question, the response is often different depending on who you are talking to.

It should be noted that an LLC might work for some while an S corporation could be better for others – there is no “one size fits all” approach to entity selection.

In short, here are a few pro’s and con’s for the LLC and S Corporation entity structure:

LLC –

- PRO – Divide profit as members see fit

- CON – Passthrough income subject to self-employment tax if member has personal liability for debts of LLC or actively participates in trade or business of LLC

S Corporation –

- PRO – Passthrough income is not subject to self-employment tax. Only employee-shareholder “reasonable compensation” subject to payroll taxes.

- CON – Only issue single type of stock and must distribute profit based on percentage of stocked owned

Of course there are many more pro’s and con’s for each entity selection – feel free to call us with any questions and will be happy to discuss more (800) 425-0570.

For more related information visit the following links:

http://tiny.cc/xjz22x IRS: Partners’ Share Of LLC Income Is Subject to Self-Employment Tax

http://tiny.cc/smz22x 5 Common Objections to Forming a Corporation or an LLC

TAX DUE DATE – Business & Trust/Estate Taxes – September 15th, 2015 – Are you ready?

/0 Comments/in News /by mrarracheSeptember 15, 2015 – This is the last day to file a 2014 calendar year income tax return for your:

- Corporation

- Partnership

- Trust/Estate

Be aware – This due date applies only if you timely requested a 6-month or 5-month extension. If you did not file an extension then there is even more urgency to file your tax return as soon as possible – expect penalties and interest if this is the case, but contact us immediately and let’s get those penalties abated!

Also, you must deposit the third installment of estimated income tax for 2015.

If you need help filing or have questions, feel free to call us today for a FREE initial consultation (800) 425-0570 or email questions to Contact@MrSmartTax.com

Thoughts on government #Tax

/0 Comments/in News /by mrarracheMark Twain quotes on government click here

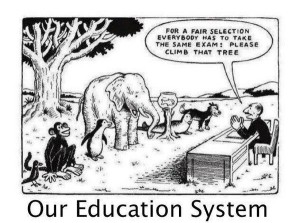

Equal vs Fair – What is the difference?

/0 Comments/in News /by mrarracheToday there are many reference to fair and equal, but do we really understand what these words mean? Do the politicians blasting their fair an equal message understand what they’re talking about?

In the most basic sense:

Fair = in accordance with the rules or standards; legitimate.

Equal = a person or thing considered to be the same as another in status or quality.

What do you think? Is being fair more important than being equal or is equality more important than fairness? Can both exist simultaneously?

#Marijuana: High On #Taxes

/0 Comments/in News /by mrarracheLegally selling marijauna? Federal law prohibits deductions for business expenses such as rent, office expenses, etc. however the IRS concedes that excise taxes levied by states on the sale of marijuana can be written off due to the fact that the tax is a reduction on the amount realized in the sale. Currently the state of Washington charges and Colorado charge a 37% and 15% tax respectively on the retail sale of marijuana. What is also notable is that the IRS will allow a deduction for the cost of the marijuana that is sold but not forfeited – a taxpayer in California had his medical dispensary raided by the feds and was not allowed to deduct the cost of the marijuana that was seized due to the fact that there was no sale.

Read more on Marijuana taxes….

Marvel Comics $16M Super Mutant Tax Trouble

/0 Comments/in News /by mrarracheNot even superheroes can save Marvel Entertainment LLC from the IRS who assessed the comic company $16.6 million in tax deficiencies due the company harvesting losses from bankrupt companies. Marvel Entertainment Group Inc and some of its subsidiaries filed for bankruptcy in 1996 and there remained approximately $97 million of net operating losses (“nol’s”) which were then carried forward to the successor company the Marvel Group in 1998. As a result the Marvel group was able to reduce taxable income with these nol’s for the years 1999-2004. According to the IRS their method of doing so was a no-no. Something tells me that his superhero magnate is not down for the count just yet…

http://tiny.cc/wjh50x

CONTACT US

4590 MacArthur Blvd

5th Floor

Newport Beach, CA 92660

(800) 425-0570 Info@mrarrachecpa.com

About

Mr. Smart Tax, Inc. Provides Tax, Accounting and Resolution for Business, Individual, Trust and Nonprofit clients.