An employee w ho, on or after July 1, 2015, works in California for 30 or more days within a year from the beginning of employment, is entitled to paid sick leave. Employees, including part-time and temporary employees, will earn at least one hour of paid leave for every 30 hours worked. Accrual begins on the first day of employment or July 1, 2015, whichever is later.

ho, on or after July 1, 2015, works in California for 30 or more days within a year from the beginning of employment, is entitled to paid sick leave. Employees, including part-time and temporary employees, will earn at least one hour of paid leave for every 30 hours worked. Accrual begins on the first day of employment or July 1, 2015, whichever is later.

Exceptions: Employees covered by qualifying collective bargaining agreements, In-Home Supportive Services providers, and certain employees of air carriers are not covered by this law.

An employer may limit the amount of paid sick leave an employee can use in one year to 24 hours or three days. Accrued paid sick leave may be carried over to the next year, but it may be capped at 48 hours or six days.

Usage

- An employee may use accrued paid sick days beginning on the 90th day of employment.

- An employee may request paid sick days in writing or verbally. An employee cannot be required to find a replacement as a condition for using paid sick days.

- An employee can take paid leave for employee’s own or a family member for the diagnosis, care or treatment of an existing health condition or preventive care or for specified purposes for an employee who is a victim of domestic violence, sexual assault or stalking.

Employers

Reminder: California Employers Required to Notify Most Employees about Paid Sick Leave

There are several things employers must do to comply with the Healthy Workplace Healthy Family Act of 2014 (AB 1522).

- Display poster on paid sick leave (Spanish) (Vietnamese) where employees can read it easily.

- Provide written notice to employees with sick leave rights (Spanish) (Vietnamese) at the time of hire.

- Provide for accrual of one hour for every 30 hours worked and allow use of at least 24 hours or 3 days or provide at least 24 hours or 3 days at the beginning of a 12 month period of paid sick leave for each eligible employee to use per year.

- Allow eligible employees to use accrued paid sick leave upon reasonable request.

- Show how many days of sick leave an employee has available. This must be on a pay stub or a document issued the same day as a paycheck.

- Keep records showing how many hours have been earned and used for three years.

Retaliation or discrimination against an employee who requests or uses paid sick days is prohibited. An employee may file a complaint with the Labor Commissioner against an employer who retaliates or discriminates against the employee for exercising these rights or other rights protected under the Labor Code. Local offices are listed on our website at http://www.dir.ca.gov/dlse/DistrictOffices.htm.

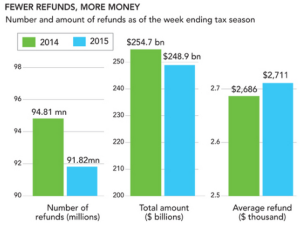

Refund Season? As data shows, the 2014 tax year had less refunds but bigger refunds.

Refund Season? As data shows, the 2014 tax year had less refunds but bigger refunds.

The average US household carries approximately $16,000 of credit card debt; average mortgage debt $157,000; average student loan $33,000 (source http://tiny.cc/ee3q0x) … that is approximately $10,000 of interest per year :/

The average US household carries approximately $16,000 of credit card debt; average mortgage debt $157,000; average student loan $33,000 (source http://tiny.cc/ee3q0x) … that is approximately $10,000 of interest per year :/

ho, on or after July 1, 2015, works in California for 30 or more days within a year from the beginning of employment, is entitled to paid sick leave. Employees, including part-time and temporary employees, will earn at least one hour of paid leave for every 30 hours worked. Accrual begins on the first day of employment or July 1, 2015, whichever is later.

ho, on or after July 1, 2015, works in California for 30 or more days within a year from the beginning of employment, is entitled to paid sick leave. Employees, including part-time and temporary employees, will earn at least one hour of paid leave for every 30 hours worked. Accrual begins on the first day of employment or July 1, 2015, whichever is later.