The Ups and Downs of Refund Season 2014

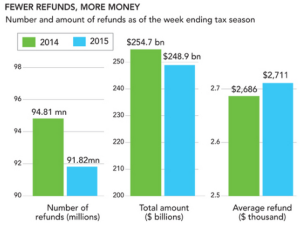

Refund Season? As data shows, the 2014 tax year had less refunds but bigger refunds.

Refund Season? As data shows, the 2014 tax year had less refunds but bigger refunds.

With the aid of government subsidized credits – the premium tax credit for health insurance, earned income credit for low income taxpayers and education credits – refunds increased for low income taxpayers while taxpayers with incomes typically over $50K saw their taxes go up and their refunds go away.

Some will argue that the taxpayer with income over $50K subsidizes the under $50K income taxpayer, but none the less these trends do not seem to be reversing anytime soon and with the 2016 election race underway it will be interesting to see how this plays out.

Leave a Reply

Want to join the discussion?Feel free to contribute!