My Notes On 2021 Economic Forecast presented by Chapman University

I recently attended an Economic Forecast presented by Chapman University via live webinar and here are my notes.

You can view a recording of the presentation here https://economicforecast.chapman.edu/2020-presentation/

- General Notes

- Presenters included James Dotti and Fadel Lawandy

- The Chapman economic forecast has historically been one of the most accurate predictors of economic performance for over 30 years

- James Dotti and his team have successfully predicted 17 of the last 18 presidential elections.

- What happened in 2020?

- Predicted a mild decrease in GDP growth(+2%), but COVID happened and annual GDP decreased by a large amount (-3%.)

- Government Officials at State Level made exaggeration of an ermergency and unnecessarily shut down the economy

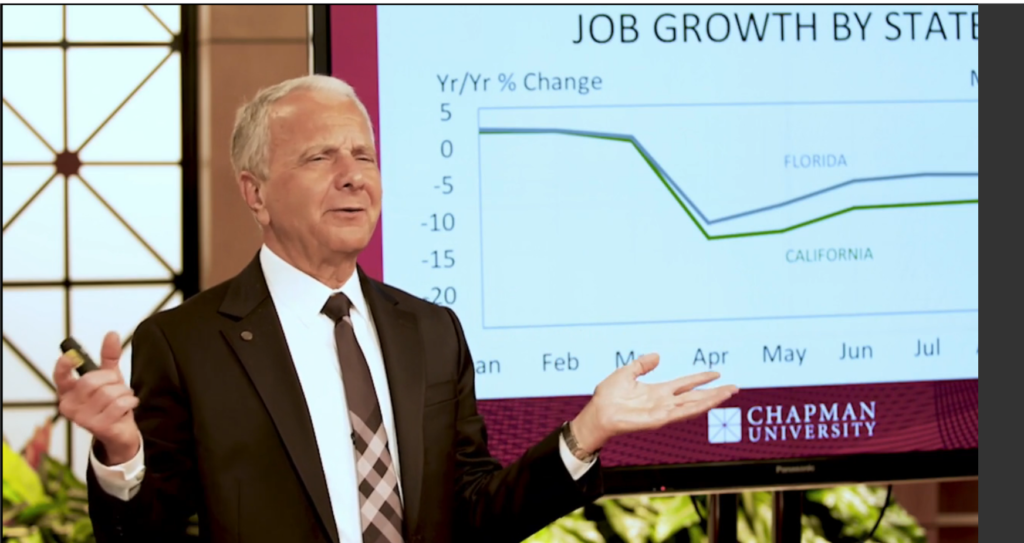

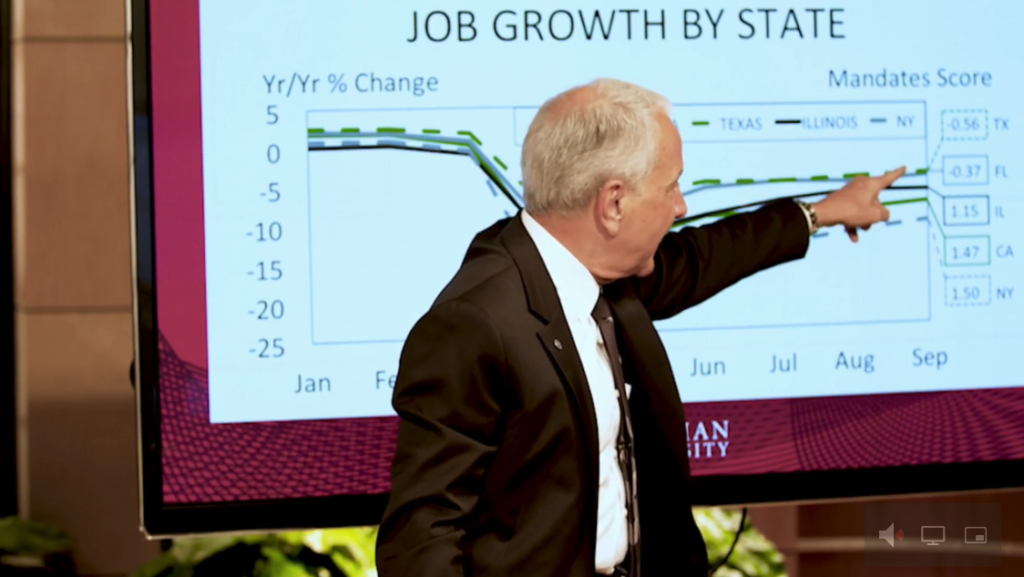

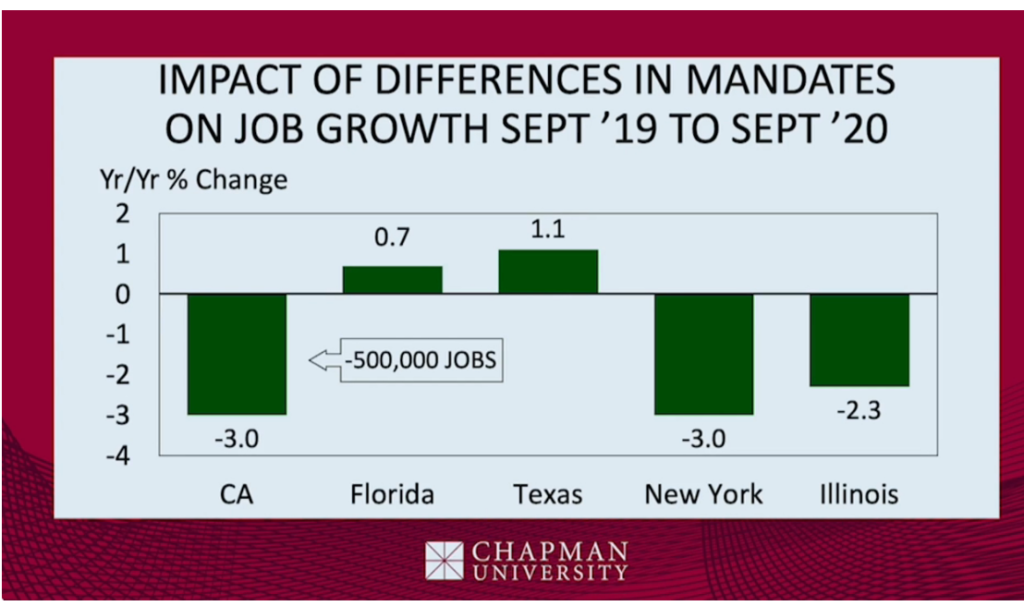

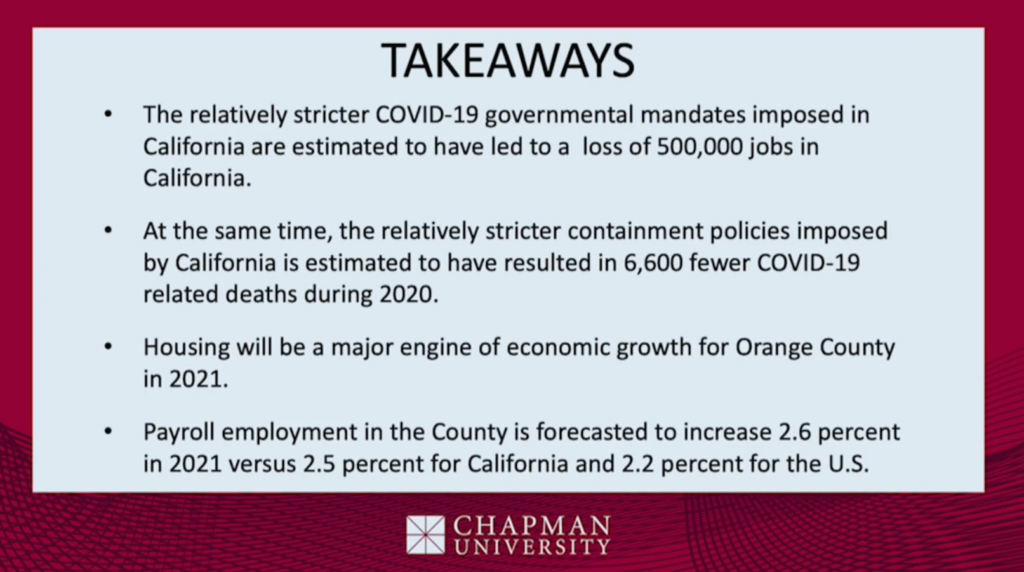

- Covid Shutdown Cost: California shut down mandate causes loss of 500,000 jobs and countless businesses

- Covid Shutdown Benefit: California shut down mandate saves 6,600 lives…

- States with less stringent shut down mandates saw less job loss and stronger economic revovery

- 2021 is going to be volatile with opportunities for buy in the short-term dips but expect long-term growth.

- Growing Pent up demand – personal wealth dramatically increased in 2020 by 10%.

- Housing affordability is at a recent all time high with historic low interest rates. Recent GDP recovery was driven primarily by consumer spending, not housing which is not necessarily good news. Watch housing market closely in 2021

- Stock Market performance is based on how the economy is predicted to perform. Currently predicted at modest +/- 3% growth. Historically, Dem Pres, Rep Senate and Dem House produce the best results for the market +/- 16%. IF Dems control all 3, then historically market +/- 6%.

- Government spending good for economy and will drive inflation which is good in short term but overall will cause problem down the road. Due to the coronavirus pandemic, Congress and President Trump enacted the $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act (CARES) on March 18, 2020. The Committee for a Responsible Federal Budget estimated that the budget deficit for fiscal year 2020 would increase to a record $3.8 trillion, or 18.7% GDP.[5] The CBO preliminary estimate for the fiscal year 2020 deficit is $3.1 trillion or 15.2% GDP, the largest since 1945 relative to the size of the economy.[6]

- Remote life will change the structure of work life, more comparable to women in the workplace during World War II.

- Expect a lot of commercial real estate properties to change purpose or be elimated all together such as Hotels, Retail, Office Buildings, etc. Estimated 20% of NYC Hotels and Retail will close forever.

- Innovation regions are a major focus for real estate investors because high paying jobs create local wealth and investment opportunities.

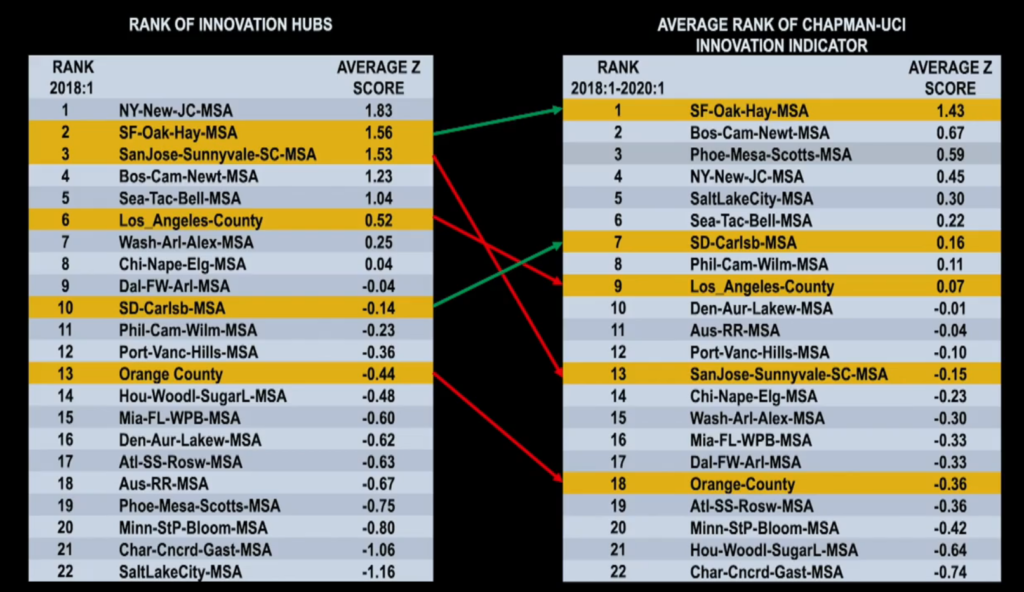

- Phoenix, Carlsbad, Reno and Salt Lake City are areas of interest for innovation hubs with real estate and tax advantage opportunities.

- Orange County needs to create more high-paying tech jobs to replace the Hospitality/Leisure employment loss to remove two-tier society.

- Artificial Inteligence will create a lot high-paying tech jobs.

Thank you to Chapman University, speakers and sponsors for an amazing 2021 economic forecast. Some great takeaways including my favorite Real Estate tip – buy where the son goes in the winter.

Until next year, thank you and take care.

Contact our CPA today if you any questions about this article or want to talk more about your business or taxes.

Leave a Reply

Want to join the discussion?Feel free to contribute!